Nuclear Power and the SPUT Tracker

Nuclear energy is seeing a much-needed renaissance | Sprott Physical Uranium Trust (SPUT) has tightened the screws on the Uranium market. This is exciting.

Disclaimer

This is not investment advice and should not be relied on for an investment. I am not selling securities in this or any other stock / investment idea I post here, or in general. I may or may not own shares and may or may not be purchasing shares in the future. All of this may be wrong and my assumptions about nuclear power and Uranium may be incorrect, as could be my references / sources. As they say, all models are wrong, some are just more wrong than others, so do your own homework before putting your hard earned dollars down.

Also, this post is too long for email, so please open it on the app or website.

Nuclear Power: The Original Green Energy

Overview

To quote an influential green chicken:

If the almost magical power of nuclear energy were discovered today, it would be heralded as a transformative and breakthrough invention to be widely celebrated.

I have believed, since I was in elementary school and learned what it was, that nuclear power was an almost magical source of energy (in agreement with Doomberg, who is the green chicken quoted, for those not in the know). I will never forget reading the Encyclopedia Encarta article on my family computer about nuclear energy, what it is and where it comes from. Using the early iteration of the internet, I found a version of this satirical Washington Post article posted on some early version of a blog (likely improperly cited and/or stolen, I imagine, but who am I to say given this was around than 25 years ago and my memory isn’t perfect) about how to make an H-Bomb out of stolen Uranium and vacuum cleaners. Before getting in trouble with my parents and having a sit-down regarding how the FBI may now be monitoring our internet connection (I did have a kids AOL account, after all, and they got the notification that I was looking at some *interesting* content for a 10 year old), I learned a LOT about how nuclear energy works, the concept of critical mass and how simple it is to generate energy. All you need to do is put two lumps of special metal close to each other and presto, energy. Magic.

Lord Albert, god of science, gave us the equation for this, and it happens to be the most famous equation in history:

It is this simple equation that gives us the recipe for energies that are incomprehensible to the human mind. To put it in context: if we were able to “convert” 100% of the mass contained in a dime (2 grams) to pure energy, it could launch a Saturn V rocket to the moon and back around 15 times. The energy contained in a child’s piggy bank could destroy civilization many times over, and they say pennies are useless.

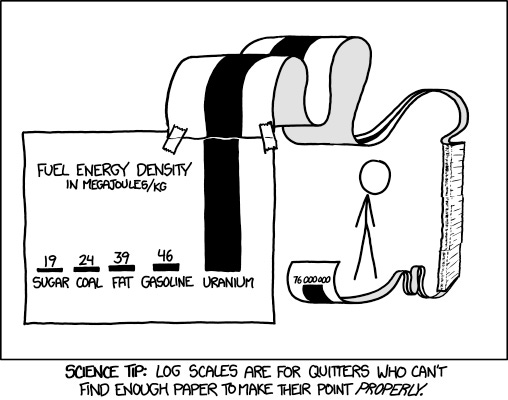

In reality, we cannot easily “convert” matter directly to energy at a 100% rate without some new science being discovered to make anti-matter harvesting a lot easier (or something else we can only dream of), so we do the next best thing: let radioactive elements decay and split each other up, which releases a ton of energy in the form of heat. This heat is traditionally exchanged with cool water, which becomes superheated and turns to steam, which spins turbines and generates electricity (there are other ways, such as RTGs with spacecraft, or molten salt, etc., but simplest to understand is the heat-to-steam that happens in most reactors). Only ~0.1% of the mass is “converted” and that still generates a stupid amount of energy when compared to anything else. For some context and a little fun, XKCD has this classic cartoon that highlights the ridiculousness of matter/energy “conversion”.

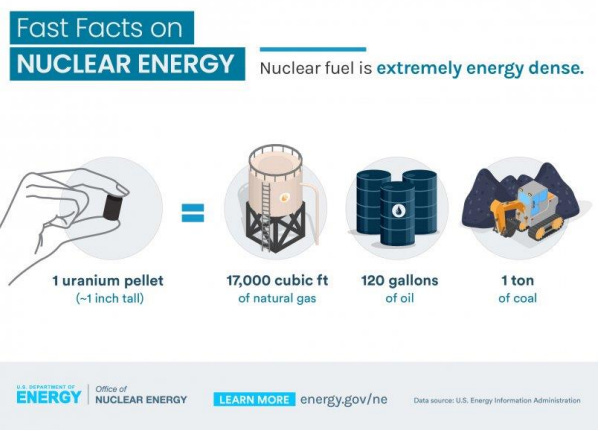

Here is another chart from the US Department of Energy. It is striking and even more compelling. To put it in simpler terms, Uranium is ~45,000 times as energy-dense as oil.

Common Misconceptions

Now that we have a basic understanding of the energies involved, we can begin to understand why nuclear is so necessary for humanity’s future, especially if we want to reduce carbon use (I am not going to open that barrel of monkeys here, as there are plenty of other people who do that for a living and I would rather just keep this apolitical, given how polarizing that discussion is). The biggest critiques on nuclear energy are usually around four key areas: 1) waste, 2) melt downs / accidents, 3) nuclear proliferation and 4) cost. I am not going to delve into all of these, since people way smarter than me are a Google search a way and can discuss these in more depth, but I do need to do a brief overview on why all four of those are either outdated, misinformed opinions or outright lies.

Waste

High level nuclear waste, or the stuff that is really, really scary and lasts centuries, is a very small volume, especially in comparison to the energy emitted. Importantly this is all contained and accounted for, which cannot be said of any other electricity generation, or really any other product, generally (what do you think happens to all the ash at a coal plant? the exhaust from a gas plant? the solar panels when at the end of life? the tailings at a lithium mine? the turbines and blades of a windmill?, etc.). Humans are also pretty smart and are good at building stuff that lasts a while, like the pyramids, which were built 5,000-6,000 years ago, so this high level scary waste that is very dangerous for hundreds of years is encased in ridiculously strong steel and concrete vessels that can literally be hit by a train and lit on fire to thousands of degrees before they break (don’t take my word for it: sweet train test here).

Back to the volume, how much is there? I am glad you asked… the entirety of the high level scary nuclear waste produced by one 1,000MW nuclear power plant (that can supply more than 1 million people with reliable electricity) can fit in a New York apartment’s bathroom; I am using this because I lived in New York before moving back to LA and measured my bathroom, which was approximately 3 cubic meters, or the same volume of the high level scary waste mentioned. As a result of this ridiculous density, the waste from the entirety of the US fleet of nuclear reactors since the beginning of their operation could fit within a big-box store or football field (American football anyone not reading this in freedomland and who actually uses practical units of measurement, but as they say, there are two kinds of countries- those who use the metric system and those who have landed on the moon). And remember, since it is radioactive, it is all heavily monitored and tracked to perpetuity. Waste is not an issue, never was an issue and never will be an issue, and anyone who says otherwise is misinformed or has an agenda.

Meltdowns and Accidents

Harvesting energy, no matter what kind, is dangerous. We are taking energy that was perfectly happy sitting where it was for millions or billions of years and extracting it to do useful work, so there are bound to be accidents. Nuclear is different, though. When an oil refinery blows up, people get hurt, or worse, and people in the neighborhoods / the immediate area get upset and scared for their immediate safety, but generally forget about it pretty quickly. Nuclear is a completely different animal because radiation is scary and lasts much longer than burned up oil refinery bits. Radiation is invisible, tasteless and cannot be easily quantified without a device to measure it (Geiger counter). Soot / smoke, on the other hand, is easy to see, easy to identify and easy to quantify (“I can’t see 3 feet in front of me through this smoke…”), and we have far more experience with it. For these reasons, nuclear facilities are incredibly safe and are designed to be fail-safe (literally safe from failure, or walk-away safe). This does not always happen as intended, and there have been three high-profile accidents since the nuclear age began (Three Mile Island, Chernobyl and the recent one at Fukushima), and the term “melt down” is usually thrown around to describe these incidents.

Before we dig in more, it is important to understand what a melt down even is: the core loses cooling for some reason or another, overheats and literally melts the metal fuel in a nuclear fire hotter than the surface of the sun (this is what happened at Chernobyl and at Fukushima, and partially at Three Mile Island). The way that reactors in the West are and always have been designed was such that if cooling is lost, the reaction stops. Western reactors use something called a negative void coefficient and a negative fuel temperature coefficient. The two of these, among other important metrics, tend to arrest the reaction when the water coolant is removed. These designs are more expensive due to higher Uranium enrichment requirements. Reactors in the Soviet Union were designed using a cheaper design that did not have these critical safety features, and in fact, as you lose cooling, you get more reaction happening. Scott Manley did a great video on this when the HBO show Chernobyl came out.

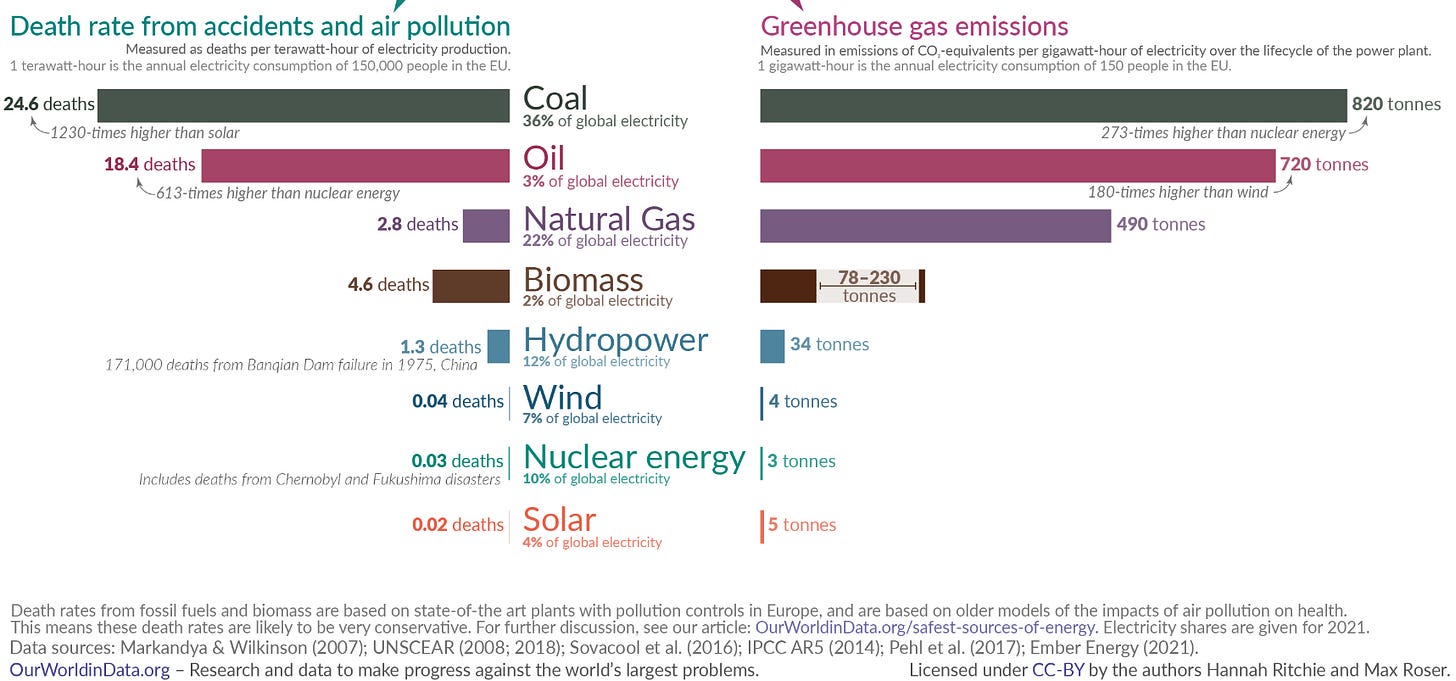

All three of these events were melt downs as defined, but Chernobyl was very different, which is why it was far more severe than Three Mile Island and Fukushima- Chernobyl did not have a containment vessel, which contains the reaction products in the case of a melt down scenario. The lack of a containment vessel allowed radiation to spew out, causing all the bad effects that we read about today. It is estimated that 31 people died directly as a result of radiation exposure and up to 4,000 may have died prematurely as a result. In the case of Fukushima (the second worst accident) one person may have died of radiation exposure and up to 2,500 old people died as a result of a rushed and unprepared evacuation of the area; the containment dome was not breeched, and kept all the nasty stuff contained and safe. At Three Mile Island, another facility with a robust containment dome, there was no radiation release and no deaths or ill-effects.

Three pretty major accidents in ~75 years of nuclear power seems like a lot, but when you consider it on a per TWh basis (a comparable unit of electricity generation) the results are striking, especially if you compare it to CO2 emissions. Accidents will always be there (energy is dangerous by definition), but nuclear reactors are designed specifically to avoid them as best as possible, and the latest generation of reactors are even safer and have even more “walk-away” safety features. Don’t take my word for it either, there are tons of resources on this, and I am just citing my favorites.

Nuclear Proliferation

Nuclear proliferation is one of those straw man arguments naysayers like to use to highlight the dangers, and to link nuclear power (good) to nuclear weapons (bad). Technologies to enrich natural Uranium to weapons-grade are tightly guarded secrets, and are often deemed classified for this reason. Unfortunately, there is not much that can be done to reduce the risk of a rogue country developing a nuclear weapon using Uranium, especially if they mine the Uranium and develop all the technology to enrich that Uranium in-house (Uranium is a relatively common element in the earth’s crust). All one needs to do is look at North Korea to see this in action. Alternatively, we can look at Iran for a showcase as to how hard it is to create a bomb when the rest of the world doesn’t want you to.

The technologies to produce enriched Uranium at the scale and purity needed for a nuclear bomb are relatively similar, but to enrich to the levels needed for an explosion takes exponentially more effort and time. Power plants typically enrich Uranium to 3%-5% U235 and sometimes up to 20% for newer reactor designs (U235 is the good stuff that is fissile (breaks apart when hit by the emitted neutrons of another Uranium atom splitting and continues the chain reaction) but only makes up about 0.7% of naturally occurring Uranium, which is why you need to concentrate, or “enrich” it; the vast majority of the rest has three additional neutrons and is called U-238). To make a Uranium-based nuclear weapon, enrichment levels need to exceed 80%, which is far more difficult. Uranium bombs are typical for a simple nuclear bomb because they really are basic (slam the right size slug into the right size plug at the right speed and boom), but Plutonium-based bombs are also a reality, and Plutonium is a byproduct of regular fission in nuclear power plants. Plutonium-based architectures are far more complex, requiring much greater precision than Uranium, which raises the price of admission to joining the nuclear club. On top of this, it’s not easy to make Plutonium without someone noticing because nuclear reactors for electricity are specifically designed to “burn up” Plutonium during the process energy generation process.

If someone has enough money and time they will make a bomb. There is also enough incentive for everyone else to ensure that the worst actors are as impeded as possible. Peaceful use of nuclear energy does not contribute to nuclear proliferation concerns, especially with modern designs, any more than buying oil in the open market supports regimes that are naughty (Russia is having no issues selling oil and neither is Iran).

Cost

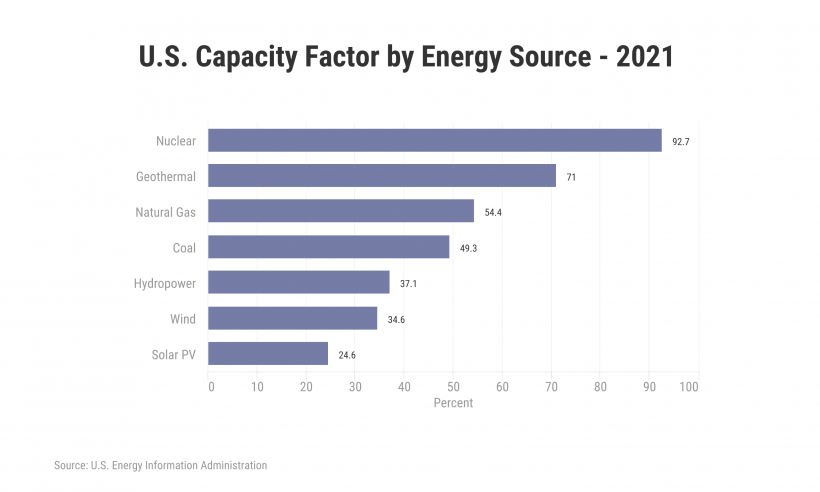

This one is a bit tough because most of the cost in a nuclear plant goes to the up-front build, permitting costs, environmental research and mediation costs, etc. Critics of nuclear often cite the LCOE (levelized cost of electricity) as the dagger that should put nuclear to bed once and for all because of how cheap LCOE of solar and wind have become. This is a false comparison because LCOE is not intended to compare intermittent energy sources with baseload ones. Solar and wind only generate electricity when the sun is shining and wind is blowing, so your opportunity cost of not generating electricity on a windless night is not being captured. What if it is cold and that energy is needed right now? Well naturally supply and demand would suggest that electricity prices will go up, and whoever is generating that last Watt, will be making the most money. Grids with excess renewables are less stable than those with less renewables, with some grid operators having to curtail solar generation in midday in California, for example, as the energy would have nowhere to go since demand for electricity peaks after the peak production of electricity. How do you put a price grid instability?

What is a more “fair” way to look at the costs?

Capacity factor is usually a good true comparison of the utility of a power generating technology. The EIA defines this as:

The ratio of the electrical energy produced by a generating unit for the period of time considered to the electrical energy that could have been produced at continuous full power operation during the same period.

Put in other terms, it is the time that electricity is being created divided by the total time of the measurement. With this definition in mind, we can look at the following chart from the US Department of Energy and see something interesting about nuclear, which should also give you some intuition as to why nuclear is the safest power source per TWh. It is on all the time. It has by far the best capacity factor, meaning once you turn a nuclear plant on, it is only down for refueling. Pretty remarkable.

Okay, so nuclear plants are always on, big deal? What about energy payback? Surely nuclear plants use a lot of concrete, metal, and other exotic materials and have to mine, enrich and transport the fuel, etc.; doesn’t that add up? Of course it does, like everything else. This concept is that of Energy Return on Investment (EROI); simply put, it is a comparison of how long it takes to “pay back” the upfront energy costs with energy generated by a facility. Doomberg has estimated that for a solar plant in the US, this is approximately five years, which if the plant is running for 20 or so, seems like a decent return. It is estimated that a nuclear plant can payback its total upfront energy costs in… 6 weeks. No matter how you cut it, this is either one or several orders of magnitude faster than renewables.

You may say that I have only deflected away from dollar costs, because as they say “show me the money”, but I am merely pointing out that it is not a simple comparison. Nuclear facilities are extremely expensive, in part, due to the extremely tight regulation to build one, which I am not sure is a bad thing. Another area that needlessly boosts costs is the non-standardization of equipment and facilities. Each nuclear plant is basically 100% custom and built to a nearly-new design, every time. Small Modular Reactors (SMRs) are changing this, as these will be small (approximately the size of a tractor trailer in some cases) and built in factories on an assembly line, like cars. This will have the effect of dramatically lowering costs due to economies of scale. I admit that there is no perfect comparisons between nuclear and renewables, but one thing that is for sure, once the government stops subsidizing renewable projects, profit margins are coming down.

Uranium Supply is Tight

A few years ago, once I dug deep into nuclear power, I came across some data on the Uranium market. Uranium is the primary fuel for which there is no substitute. Thorium reactors have been touted for decades as a replacement, and it is true, they are great pieces of technology, but they have not been commercialized yet, and will not be for at least a decade, so we are stuck with Uranium for now. Uranium is pretty interesting in itself simply because there is so much of it in the earth’s crust, but not many people mine it and like all minerals, there are areas of intense concentration scattered around the world. The last decade or so has seen nuclear power go out of favor, catalyzed by Fukushima. It became dirty, scary and dangerous to have nuclear power as a part of your solution. Solar and wind are forms of nuclear energy, after all (the sun is a nuclear fusion furnace and both are direct effects of solar radiation), so why do we need that here? Well those theories were wrong and we desperately need more nuclear power, and governments are getting wise to this, and rapidly.

Once convinced of its necessity and lack of long term supply (I am not here to convince you of that, there are way more people smarter than me on the tightness of the market out there- following Uranium Insider (@uraniuminsider), John Quakes (@quakes99), Yellowbull (@yellowbull11) and Napalm (@napalm_1_) on Twitter are great resources) you may ask, “what now?”, as I did. I bought some miners, which are generally VERY risky (most of those will never produce a pound and are equivalent to buying lottery tickets), except for some of the big boys that actually mine and produce Uranium. What about just buying physical pounds and holding them, like you would with gold? Well since you can’t just buy a drum of yellow cake and keep it in your garage, the next best thing is to invest in someone whose sole purpose in life is to do just that, which brings me to the Sprott Physical Uranium Trust (“SPUT”; OTC Ticker: SRUUF).

What is SPUT?

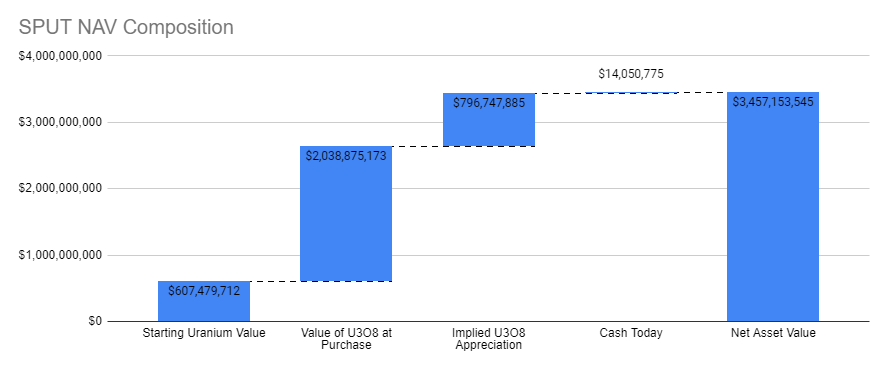

SPUT is managed by Sprott Asset Management, which is a large asset manager specializing in rare metals and commodities. They have several vehicles for investing in precious or critical minerals, and physical trusts are one of them. In this vehicle, they raise money from outside investors, purchase pounds in the open market and then sequester those pounds. This has the benefit of tightening the market and allowing investors to “own” a stake. Pretty nifty, if you ask me. This trust came about when Sprott bought Uranium Participation Corp (“UPC”) in 2021, which is when I was drawn in. Once Sprott closed the deal to buy UPC, they started buying, and fast. They published the stats every day on their website. Being the good banker I am, I wanted a way to track the progress on a daily basis, and being lazy efficient, I wanted this to be mostly automated. And this is how the SPUT Tracker was born.

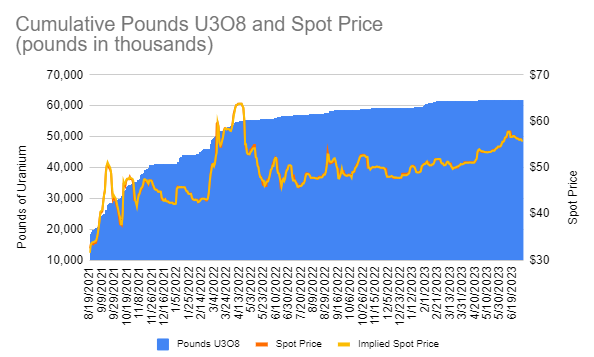

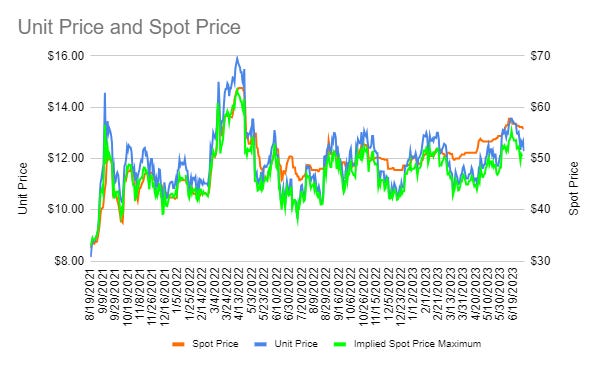

Sprott can issue shares in SPUT to the open market any time SPUT’s shares trade at a premium of 1% to the net asset value of the fund. Put another way, if the total “market cap” (I put these in quotes since this is a trust and not a company, so market cap is not technically right) of SPUT’s shares is more than 1% above the total net asset value of SPUT’s holdings (e.g., all the Uranium and cash held), then Sprott can issue. Issuing these shares raises cash, which is then deployed to buy Uranium. When SPUT trades at a discount to NAV, then SPUT is on the sidelines, just waiting for either the price of the units to rise above the 1% threshold, or for the price of Uranium to come down. Using this concept of discount or premium to NAV, we can calculate an implied Uranium price, based on this, since SPUT is the market’s biggest buyer. As of 7/5/2023, SPUT trades at a ~12% discount to NAV, with a Uranium spot price of $55.75 per pound. This means that the implied uranium price is $49.00 (or $55.75 * (1-0.12)). SPUT cannot issue shares unless Uranium prices fall to this floor price or unless SPUT trades above the NAV. SPUT also only buys “yellow cake” Uranium (U3O8); this is what comes out of the ground after some light refining. This is not what goes into reactors- it first needs to be converted to UF6, which is a gas and is spun in centrifuges to be enriched. Once enriched, the UF6 is then converted to enriched Uranium metal and other fuel rod components are mixed in. John Quakes has a great thread on this and general Uranium investing here.

The SPUT Tracker is a freely available, public Google Sheet that has been updated every day for the last two years. It shows the raw data from Sprott, along with analytics regarding purchasing and implied values galore; a data nerds dream. On top of this, it’s got charts. Lots of charts. Charts so good, Sprott has them on their site; no joke, many of the charts they show were originally on the Sputt Tracker, which I know they saw since thousands of people worldwide, including CEOs of mining companies and professional investors have referenced it. In the tracker you can find a number of helpful charts that help paint the picture of what is happening in the market in real-time. Below are a few of my favorite standard charts:

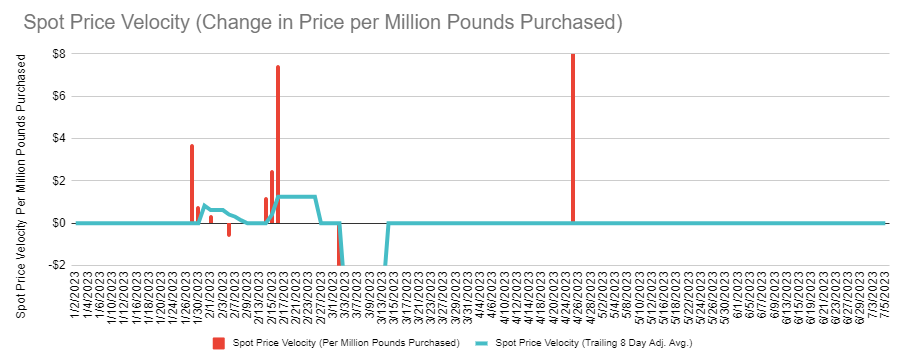

These charts are pretty standard ways to view this, but below is my personal favorite, and one that I think shows a lot about current market tightness: the spot velocity. This was a measure I made up and helps showcase how tight the market is because it is defined as:

If velocity is higher it means the price of Uranium moved a lot for a small purchase (implying tighter supply), and if velocity is lower, it means the opposite (implying lots of supply). In the SPUT Tracker, I define velocity on a per million pound basis, which is just easier to use effectively and is roughly the Uranium used by one nuclear power reactor over two years; a decent and practical volume to review. Below is the velocity this year. SPUT has been trading at a discount for most of the year, so the velocity is zero much of the time, since pound have not been purchased.

From the data presented in my tracker, it can be seen that since Sprott took over a little less than two years ago, they have sequestered ~50 million pounds of Uranium, or the equivalent of around 100 reactors-worth of fuel for a year (~20% of the global mined supply since acquisition). This Uranium will never make it back to market. As I mentioned before, this is getting exciting and I can’t wait for my tracker’s lines to start moving again. Thanks for reading.

Next up is another deep dive into a company I like. If you have any suggestions, please let me know.

Astronomy Wrap Up

As promised, here is your reward for finishing this long article.

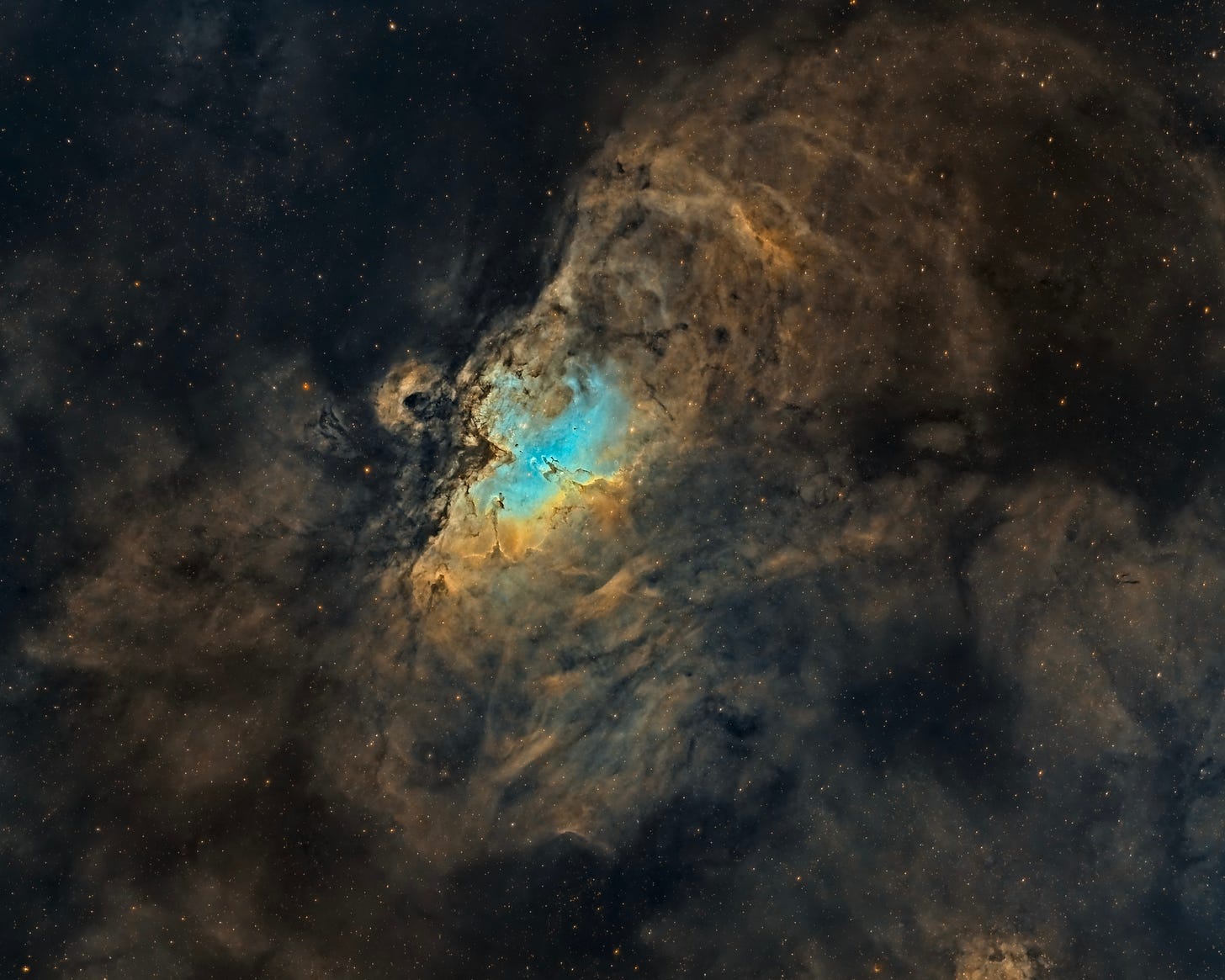

This is the Eagle Nebula (M16) shot from my balcony in West Hollywood, CA. It is processed using the Hubble pallet (Sulphur = Red, Hydrogen = Green, Oxygen = Blue) and has the very famous Pillars of Creation in the middle (zoom in and you’ll recognize the famous Hubble Telescope image).

Glad I could be helpful! It’s a labor of love for sure

Thanks Alex. I've been working through the spreadsheet, and like the additional analytics (eg, Implied Uranium Price) and charts that you added over and above the core data that Sprott provides.